Safety

5 Ways to Reduce Your Homeowners Insurance Costs

Homeowners insurance is necessary to have and is required by most mortgage lenders until you’ve paid your mortgage in full. It can be costly if you’re not careful, but it is possible to get the coverage you need at a price you can live with. Here are five tips for reducing the cost of your insurance without leaving yourself exposed with inadequate coverage.

Play it Safe

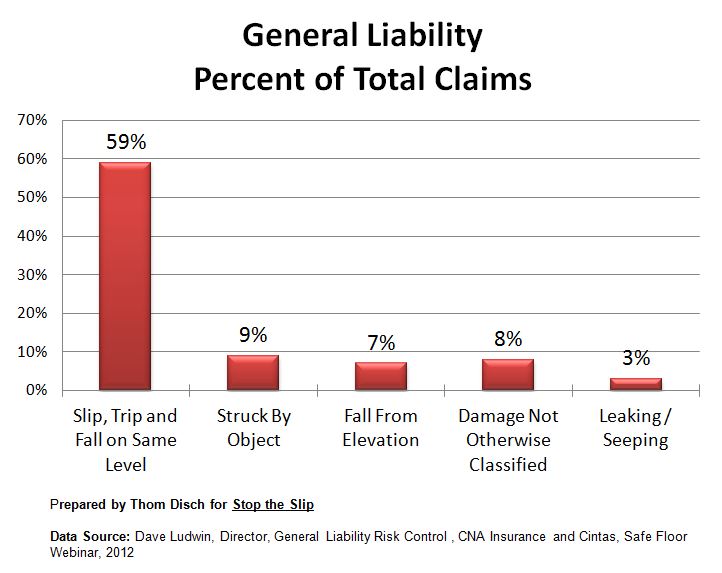

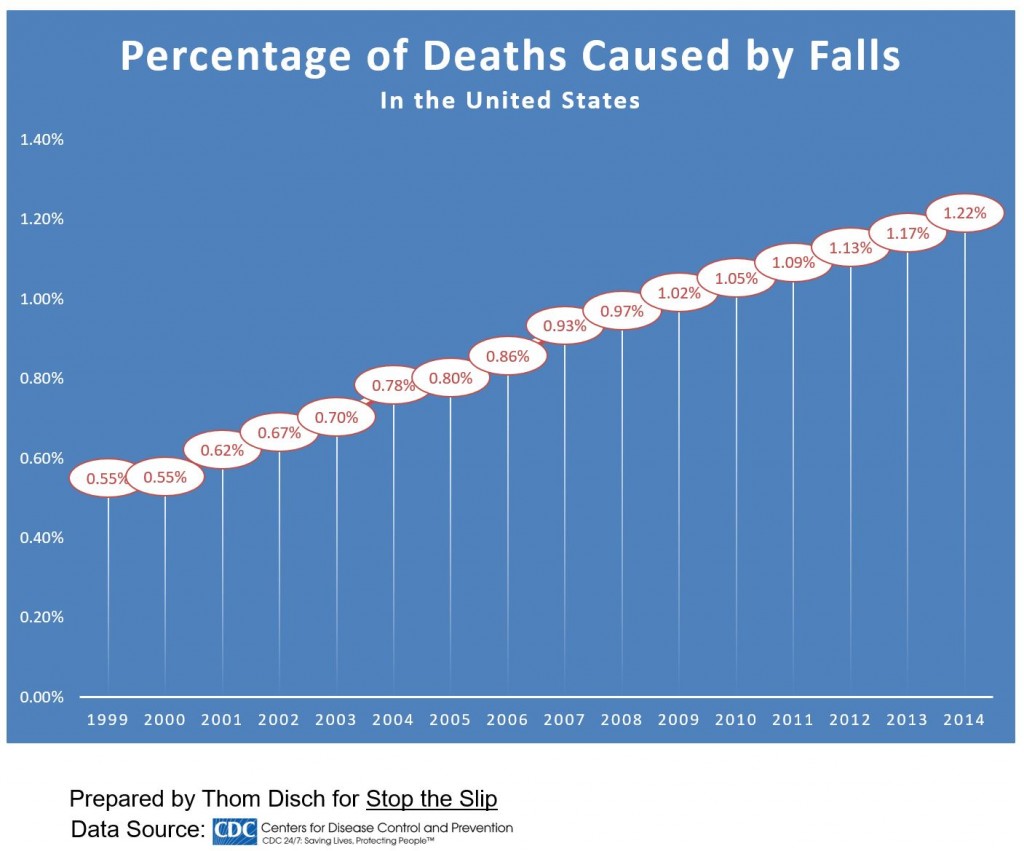

The safer you make your home, the lower your insurance premiums will be. It’s simple as it can get. Make your home safe not only for you, but for your guests and visitors as well. At least bring down risks of liability claims to minimum. According to CNA Insurance 59% of all liability claims are related to Slips and falls, while deaths from fall injuries increased dramatically during last 15 years. Also, consider adding an alarm system, hard-wired smoke detectors and deadbolts. Insurance companies don’t like to see houses with brush, dilapidated outdoor structures and other fire hazards close. Products such as grab bars and handrails can reduce homeowners premiums because they minimize the risk of and liability that accompanies falls.

Adopt Carefully

Many insurers maintain a list of dog breeds they feel are aggressive, and owning one increases your insurance premiums. Pit bulls, rottweilers and other popular breeds are often on these lists, so check with your insurance company before buying a puppy or adopting a shelter dog. If you already have one of these breeds, love them fiercely, as just about almost everything we love comes at cost.

Increase Your Deductible

One of the most effective ways to lower your homeowners insurance premium is to raise your deductible. This will increase the mount you pay out-of-pocket before your insurance coverage takes over, but greatly reduces premiums. This strategy can pay for itself over the long-run so it’s worth consideration. According to the Insurance Information Institute, taking your deductible from $500 up to $1,000 can decrease your premiums by 25%.

Don’t go Overboard

You need adequate coverage to rebuild your home and replace its contents, but it’s easy to overestimate the true value of these items. Remember that the purchase price of your home reflects its fair market value at the time, not what it would cost to rebuild the structure. It may take less money to rebuild than it did to purchase since you’ll already own the land. While it’s important not so skimp on your coverage, it’s a waste of money to buy more insurance than you’ll need. Excluding land value from your coverage may result in significant savings.

Bundle Up

Most insurance companies are happy to offer discounts to customers who hold multiple insurance policies with them. This means you could save money simply by getting your homeowners insurance through the same company that provides your car insurance. Shop around for an insurance company that provides good pricing on all of the insurance you need and see who is willing to package policies together for the best multi-policy discount. This is a simple savings method but an effective one, potentially reducing your premiums by 5 to 15%. Don’t assume every bundle will save you money though. Shop around and be sure your discounted bundle rate is less than buying two reasonably priced policies from different insurers.

For more tips on reducing your home insurance premiums, simply have a chat with your insurance agent. Your local insurance agents work closely with your insurer and will know what discounts and reductions are available from your current provider. He can also shop around for you to make sure your current coverage is still adequately meting your needs and decide if there is another company that my be able to cover you for less.

Author

Michael Rogers is the Operations Director of USInsuranceAgents.com. With over 5 years of experience and knowledge in the insurance industry, Michael contributes his level of expertise as a leader and an agent to educate and secure coverage for thousands of clients.