Add a CVR to Your Business Loan When Buying a New Cargo Van

The Best Cargo Van Ramp for Small Businesses

If you’re purchasing a new cargo van for your business, have you considered adding a cargo van ramp (CVR) to the loan? A ramp can make loading and unloading easier, improving efficiency and reducing strain on workers. Many business owners don’t realize that a cargo van loading ramp can be included in their auto financing package, just like other equipment. If you’re financing a Ram ProMaster, Ford Transit, or another cargo van, we can provide an invoice or quote to add a HandiRamp Cargo Van Ramp to your business loan at the same low rate as the vehicle loan!

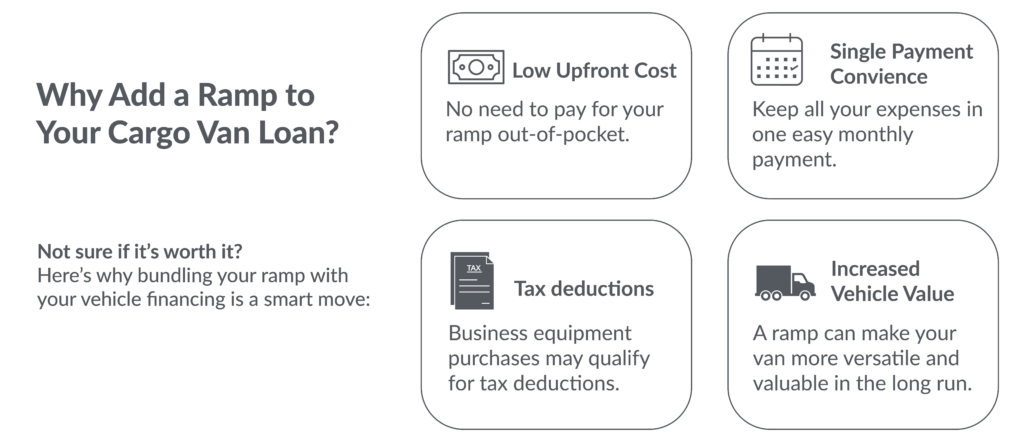

Why You Should Add a Cargo Van Ramp to Your Business Loan

A CVR is a must-have for businesses that transport goods, equipment, or tools. Whether you’re in delivery, construction, moving services, or any other industry requiring frequent loading and unloading, a ramp makes the job easier and safer. Here’s why adding one to your loan makes sense:

- Cost Efficiency – Instead of paying out of pocket, you can roll the cost into your business loan and make affordable monthly payments.

- Increased Productivity – A ramp speeds up loading and unloading, saving time and labor costs.

- Improved Safety – Reduce the risk of injuries from lifting heavy loads into a high cargo van.

- Seamless Integration – If you’re already financing your vehicle and equipment, why not include a ramp?

How Business Loans Work for Small Businesses

If you’re unfamiliar with how business loans for small businesses work, here’s a quick breakdown:

- Apply for a Loan – Work with a lender to secure financing for your van and equipment.

- Get an Approved Amount – The lender determines how much you qualify for based on your business history, credit, and income.

- Select Your Equipment – Choose your cargo van and additional equipment (like a ramp!).

- Receive a Quote – We can provide an invoice or quote for your cargo van ramp, which your lender can include in your loan.

- Finalize the Purchase – Once approved, you receive the funds to complete your purchase.

- Make Monthly Payments – You’ll repay the loan in manageable installments, often with tax benefits.

Types of Business Loans for Small Businesses

If you’re wondering what kind of loan you might need, here are some common options:

- Term Loans – A lump sum paid back over a set period, which is great for purchasing vehicles and equipment.

- Equipment Financing – Specifically designed for purchasing equipment like cargo van ramps.

- SBA Loans – Government-backed loans that offer favorable terms for small businesses.

- Business Lines of Credit – Flexible financing where you borrow as needed, ideal for ongoing expenses.

Who Usually Gets Business Loans for Vehicles and Equipment?

Many small businesses qualify for business loans, including:

- Delivery and courier services

- Plumbing, electrical, and HVAC companies

- Landscaping and construction businesses

- Moving and storage companies

- Catering and event services

If you’re financing a van, adding a ProMaster ramp, Sprinter van ramp, or another cargo van loading ramp can be easily included.

The Benefits of Adding a Cargo Van Ramp to Your Loan

How to Get a Quote for a Cargo Van Ramp

If you’re ready to include a cargo van ramp in your business loan, it’s easy!

- Choose Your Ramp – Check out our HandiRamp CVRs to find the best option for your van.

- Request a Quote – Contact us for an invoice or quote.

- Send It to Your Lender – Your lender will add it to your loan package.

- Get Your Ramp Installed – Once approved, you’ll receive your ramp and can start using it immediately!

Don’t Miss Out – Get a Ramp with Your Business Loan!

A cargo van loading ramp is an essential upgrade that makes your business more efficient and safe. If you’re financing a new van, take advantage of the opportunity to roll your cargo van ramp into your loan. Contact us today for a quote and make loading and unloading a breeze!